It also has some helpful further options, including Wave Checkouts, which lets you accept payments out of your web site with a cost link. The complete app has a pleasant vibe, with rounded fonts and simple icons. At each subscription tier, QB Self Employed offers different features. Every plan includes the QuickBooks Self Employed app that you ought to use to handle your finances on the go. In this post, you’ll be taught more about what QuickBooks Self Employed presents to customers, the professionals and cons of the software program, and different choices. QuickBooks Online and QuickBooks Self-Employed are two different variations.

Enhance Your Productivity Mechanically Use Zapier To Get Your Apps Working Collectively

Whether Or Not you’re managing a facet hustle, a full-time business of 1, or scaling your group, we’ve a collection of services and products right for you. Examine extra versions of QuickBooks On-line, including QuickBooks Solopreneur, and study more about our other options and services right here. The app automates mileage tracking with GPS, ensuring you probably can claim each mile for tax deductions. This sensible software saves you time and boosts your effectivity.

Entry your QuickBooks account at any time, and run your self-employed business on any gadget. With cloud-based accounting software program, you not https://www.quickbooks-payroll.org/ have to be at your workplace desk or computer to access your financial information. QuickBooks accounting software program for sole merchants makes it simpler for self-employed business owners like you to do accounting wherever you’re.

Submit Direct Slack Messages For Brand Spanking New Fiverr Workspace Invoices

QuickBooks Online pricing ranges from $38 to $275 per 30 days. Solopreneur is inexpensive, and Enterprise is usually pricier.

QuickBooks Self-Employed is an internet accounting tool particularly for freelancers, solopreneurs, impartial contractors and sole proprietors. This evaluate covers the totally different subscription choices for QuickBooks Self-Employed, what every provides and how QuickBooks stacks up with its rivals. QuickBooks Self-Employed is a powerful online accounting tool designed specifically for freelancers, solopreneurs, and unbiased contractors. It presents options that simplify tracking expenses, sending invoices, and even calculating taxes.

Earlier Than going through the process of setting one up, you’ll need to analysis which one might be most suitable for your small business. We’ve compared QuickBooks Self-Employed with two high opponents. Our companions cannot pay us to ensure favorable evaluations of their products or services. QuickBooks Online Easy Begin works finest with the cellular app as a result of all its options can be found. Further options supplied in QuickBooks Online Essentials, Plus, and Advanced plans are only available on the net. QuickBooks seamlessly integrates with over 500 apps you already use to run your self-employed business.

This permits users to file their federal and state tax returns instantly from the software program. This integration simplifies the tax process, making it easier to handle finances and file taxes with out trouble. One of the standout options of QuickBooks Self-Employed is its capacity to calculate quarterly estimated taxes automatically. This means users can easily see how a lot they owe and when payments are due.

- Accounting for freelancers is a extremely specific task, and I wanted to make sure I got an actual sense of how it would feel.

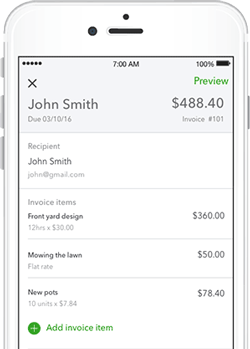

- With QuickBooks for Self Employed, the cell app capabilities are designed to simplify your financial tasks anytime, wherever.

- You want a solution that’s easy, efficient, and tailored just for you.

- All Platinum options, plus Assisted Payroll to deal with federal and state payroll taxes filings for $2.50/employee each pay interval.

Access your data on the go out of your laptop, smartphone or pill. While QuickBooks Self-Employed and FreshBooks are both paid subscription companies, Wave Accounting offers a free invoicing and accounting tool. If you may be only on the lookout for a software to generate and send invoices and hold monitor of primary accounting, Wave could be the finest option. QuickBooks Solopreneur is a “lite” version of the net product.

When paired with PlugBooks, it becomes a robust resolution for e-commerce sellers. Understanding QuickBooks Self Employed price and its advantages can help quickbooks self employed payroll you make the right selection. QuickBooks Self Employed cost management turns into easier with these strategies. QuickBooks turns into even more effective when paired with tools like PlugBooks, especially for e-commerce sellers. Evaluating QuickBooks Self Employed cost alongside these tools might help you decide. QuickBooks also presents a neighborhood discussion board where you’ll have the ability to interact with different users.

In summary, QuickBooks Self-Employed provides valuable tax options that can assist customers manage their funds effectively. With automated calculations, deduction maximization, and integration with TurboTax, it stands out as a helpful gizmo for self-employed individuals. For those who need a seamless tax filing expertise, QuickBooks Self-Employed integrates with TurboTax.